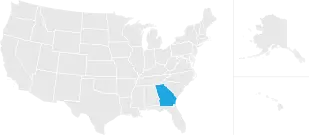

how to lower property taxes in georgia

Check to See If You Qualify for Property Tax Relief. Real Property Tax Law 425 McKinney.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes.

. The reduction means the average homeowner will save more than 20 for every 100000 of value in their property. Up to 20 cash back How do I lower my property Tax in the state of GA. Enroll in a Tax Relief Program.

This is awarded as a rebate or tax credit that is intended to cover a portion of your property tax bill. Appeal Your Tax ValuationPromptly. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence.

All property in Georgia is taxed at an assessment rate of 40 of its full market value. Boasting a population of nearly 11 million Fulton County is Georgias most populous county. Compare Tax Cards of Similar Homes.

How can I lower my property taxes in Georgia. A Guide to Claiming Fulton County Property Tax Exemptions for Seniors. So for example a typical homeowner in Georgia will pay taxes on the value of his or her house the improvements and the lot.

Fulton County collects the highest property tax in Georgia levying an average of 273300 108 of median home value yearly in property taxes while Warren County has the lowest property tax in the state collecting an average tax of 31400 051 of median home value per year. The exact property tax levied depends on the county in Georgia the property is located in. Verify the property tax record data on your home.

We use cookies to give you the best possible experience on our website. Move to a Less Expensive Area. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

Your state may also offer a tax relief program for low-income individuals. Senior Citizen Exemptions From Georgia Property Tax And if youre 62 years or older and your family income doesnt exceed 30000 a part of your home may be exempt from county tax the inflation-proof exemption. These vary by county.

How much you receive depends on your income and your property assessment. Georgia Property Tax Rates. The lower rate of 9287 mills in the unincorporated areas represents a 545 decrease in county taxes.

If you encounter a problem accessing a website on this list you will need to contact the office of the Board of Tax Assessors or the Tax Commissioner in the. The taxable value is then multiplied by the millage rate. 10 Ways to Lower Your Property Taxes Lower Your Tax Bills.

Exemptions such as a homestead exemption reduce the taxable value of your property. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Apply for Homestead exemptions.

Upon which it sits the land but the owners possessions the personal property. For qualifying seniors it exempts the first 62200 of the full value of the home from school taxes NY. When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes.

A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. Georgia Counties With Property Tax Services Online. Get Rid of Outbuildings.

As of January 1 2016 business inventory is exempt from state property taxes and since then approximately 93 percent of Georgias counties and over 140 cities have adopted a Level One Freeport Exemption. Property taxes are quite possibly the most widely unpopular taxes in. Contents1 Do you have to pay school taxes if you are over 65 in Georgia2 What.

Georgia offers a school property tax exemption for homeowners age 62 or older whose household income is 10000 or less excluding certain retirement income. The property tax system can be confusing. This does not apply to or affect county municipal or school district taxes.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. Individuals 65 years or older may claim a 4000 exemption from all state and county ad. The list below has links to county websites where property records can be searched online or property tax payments can be made online.

Property Tax Exemptions in Georgia. Its population is diverse and the county is on the rise with both median incomes and homeownership growing by 4 and 9 respectively year on yearThe largest single block of Fulton County residents own properties. The key piece of information youll want to note on yours is the year-to-year change in your propertys appraised value.

Lets say this homeowner has a standard homestead exemption of 2000. 62 years or older. Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall Barrow Walton and any other Georgia county.

How can I lower my property taxes. If youre looking for property tax breaks in Georgia the Freeport Exemption could be a beneficial one. Consumer Ed says.

Pay property tax bills on time. Tax assessors rely primarily on public. It just increased to an outrageous amount - Answered by a verified Financial Professional.

So if your property is assessed at 300000 and. Review Your Property Tax Card for Errors. 23 Apr Tips for Lowering your Property Tax Bill in 2020.

First understand that all property in Georgia ie land improvements and personal property is subject to being taxed unless it qualifies for a specific exemption under state law. Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

We lower the property tax burden for parcels all across Georgia and the Atlanta area. Know the assessment value of your home and the deadlines in your jurisdiction. City residents will also notice a 013 rollback as the tax rate in the incorporated boundaries will be set at 13275 mills.

Look at Your Annual Notice of Assessment. Verify the property tax record data on your home. Review your annual assessment notice and consider an appeal.

Georgia Property Tax Calculator Smartasset

105 Red Gate Lakes Drive Real Estate Fence Paint Back Deck

A Guide To Georgia Business Personal Property Taxes

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

A Guide To Georgia Business Personal Property Taxes

2021 Property Tax Bills Sent Out Cobb County Georgia

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Property Tax Housing Market Tax Consulting

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Pin By Georgia Perimeter Homes On Dream Home In 2022 Dream House Property Outdoor Structures

North Georgia Horse Farm Close To Milton But Resides In Cherokee County Lower Taxes 4 6acres 4 Stall Barn With Tac Maine House House Styles Horse Property

2021 Property Tax Bills Sent Out Cobb County Georgia

Georgia Property Tax Calculator Smartasset